Tankers: Oil Production Trends Pointing Towards Middle East’s Important Role for Shipping

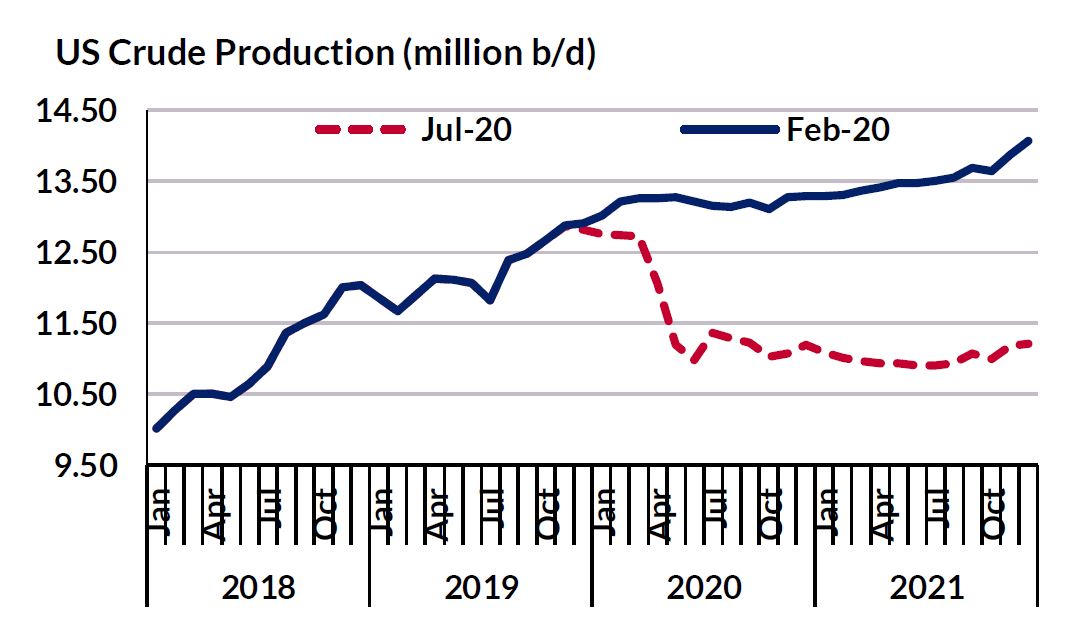

14.07.2020 The tanker market is expected to remain heavily reliant on Middle East crude flows for a little while longer. In its latest weekly report, shipbroker Gibson said that “with world oil demand having collapsed in the wake of the Covid-19 pandemic, major downwards pressure on oil production was always going to be inevitable. Indeed, the US Department of Energy recently assessed that US crude output averaged 11 million b/d in June, showing a colossal 1.9 million b/d decline from the record level reached in November 2019 as weak crude demand and limited storage availability forced large scale shut-ins. Drilling activity also came to a near halt in response to collapsing oil prices, with Baker Hughes reporting in early July the lowest active drilling rig count in the US in its records, which date back to 1987. Although a 1.9 million b/d drop is quite a sobering figure, the picture is less extreme on an annual average basis due to steep rise in US production over the course of last year and expectations that output will stabilize in the 2nd half of 2020. A survey conducted in March by the Federal Reserve Bank of Dallas showed that shale producers could generally cover operating expenses for existing wells at WTI prices between $23- $36/bbl, which suggests that the majority of shut-in output could potentially return at current prices of around $40/bbl. Indeed, some US producers have already announced last month partial reversals of production cuts; however, others, especially those heavily leveraged, still face bankruptcies”, Gibson noted.

The tanker market is expected to remain heavily reliant on Middle East crude flows for a little while longer. In its latest weekly report, shipbroker Gibson said that “with world oil demand having collapsed in the wake of the Covid-19 pandemic, major downwards pressure on oil production was always going to be inevitable. Indeed, the US Department of Energy recently assessed that US crude output averaged 11 million b/d in June, showing a colossal 1.9 million b/d decline from the record level reached in November 2019 as weak crude demand and limited storage availability forced large scale shut-ins. Drilling activity also came to a near halt in response to collapsing oil prices, with Baker Hughes reporting in early July the lowest active drilling rig count in the US in its records, which date back to 1987. Although a 1.9 million b/d drop is quite a sobering figure, the picture is less extreme on an annual average basis due to steep rise in US production over the course of last year and expectations that output will stabilize in the 2nd half of 2020. A survey conducted in March by the Federal Reserve Bank of Dallas showed that shale producers could generally cover operating expenses for existing wells at WTI prices between $23- $36/bbl, which suggests that the majority of shut-in output could potentially return at current prices of around $40/bbl. Indeed, some US producers have already announced last month partial reversals of production cuts; however, others, especially those heavily leveraged, still face bankruptcies”, Gibson noted.

According to the shipbroker, “on an annual average basis, the IEA expects US crude output to decline this year by 0.9 million b/d. A further drop in output is projected in 2021, with estimates showing an additional 0.4 million b/d fall year on year (YOY); however, that is uncertain. The concern here is a sharp reduction in upstream spending, with budgets cut nearly by half from original plans. While the US shale industry is leading the way in terms of the non-OPEC+ response to lower oil prices, crude production in other countries is also under pressure. Most notably, Canadian output is expected to decline by 0.4 million b/d YOY in 2020. Next year output is anticipated to rebound almost as strongly, yet absolute levels will be nearly 0.45 million b/d below projections made a few months ago. In non-OECD Asia, crude production is forecast to decline by around 225,000 b/d this year and a similar drop is projected in 2021, with China and India seeing steep revisions on the back of rapid declines at mature fields and spending cuts by oil companies. Elsewhere, UK crude production has been revised down since March by around 80,000 b/d both for 2020 and 2021. A similar downward revision has been made for Colombia”, Gibson said.

“Overall, only Norway, Brazil and Guyana are expected to see any meaningful gains over the two-year period as new projects start up. The IEA notes that if cuts stay in place as agreed through to April 2022 and full compliance is met, total non-OPEC output is anticipated to fall by nearly 3 million b/d year-on-year in 2020, while in the absence of increased investments in short-cycle projects, expectations are for non-OPEC supply to grow by just 0.74 million b/d in 2021. However, such a modest rebound in non-OPEC supply points to a potential tightness next year if demand recovers as expected, with the latest IEA figures suggesting a 5.3 million b/d rebound in consumption. This may represent opportunities for producers that can increase output at ease, mainly those in the Middle East as evidenced in the past. If this proves to be the case, then perhaps OPEC efforts to defend its market share will finally yield results. For tanker markets this means a greater reliance on crude flows out of the Middle East, at least for a little while”, Gibson concluded.

Source : Hellenic Shipping News