Tanker Market: Robust Levels All Around During November

16.12.2019

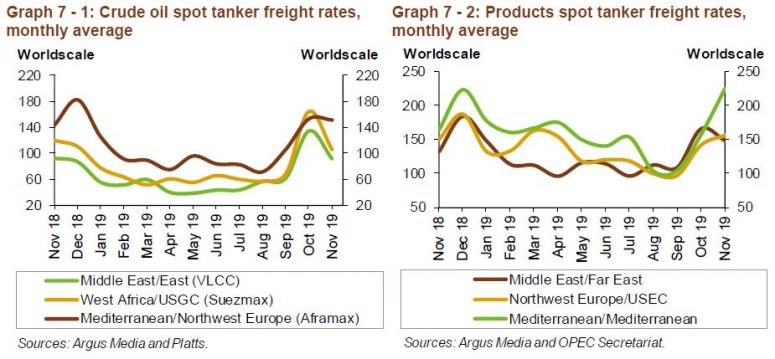

The tanker market has been on a high during November as well. In its latest monthly report, OPEC said that dirty tanker spot freight rates in November remained at robust levels relative to the lacklustre performance seen for most of this year, but were down from the record highs seen in the previous month. At the end of September, an announcement of sanctions on two subsidiaries of China’s shipping giant Cosco surprised the market at a time of seasonal uplift in demand for longer haul voyages and reduced tonnage availability due to IMO preparations, leading to panic fixing and a sharp spike in freight rates. The market regained balance in November, allowing rates to retreat, but closer to the elevated levels seen in the same month last year. Clean tanker rates also enjoyed a similar upward trend and even managed to move above the levels achieved this time last year. For the tanker market as a whole, shippers are counting on rates remaining buoyant on into the new year.

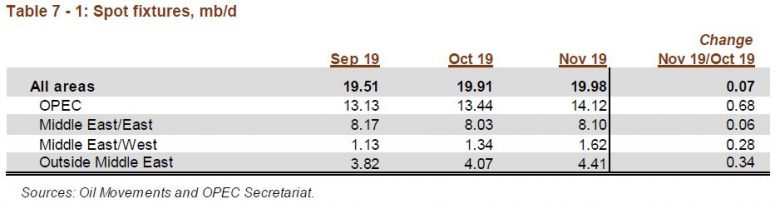

Spot fixtures

Global spot fixtures maintained the previous month’s levels in November, edging up 0.07 mb/d, or 0.3% m-o-m, but remained below last year’s robust levels, down 2.0 mb/d, or 9%, from the same month a year ago.

OPEC spot fixtures averaged 14.12 mb/d in November, some 5%, or 680 tb/d, higher than in the previous month, but still 2%, or 320 tb/d, lower y-o-y. Fixtures from the Middle East-to-West jumped by almost 21%, or 280 tb/d, to average 1.62 mb/d in November and even managed to outpace last year’s level by 2%. Middle East-to-East fixtures were slightly higher, edging up 0.8% to 8.10 mb/d. Compared to the same month last year, rates on the route fell by 3% or 240 tb/d. Outside of the Middle East, fixtures averaged 4.41 mb/d in November, an increase of 340 tb/d, or 10.4%, from the previous month, but fell 830 tb/d, or 17%, compared with the same month last year.

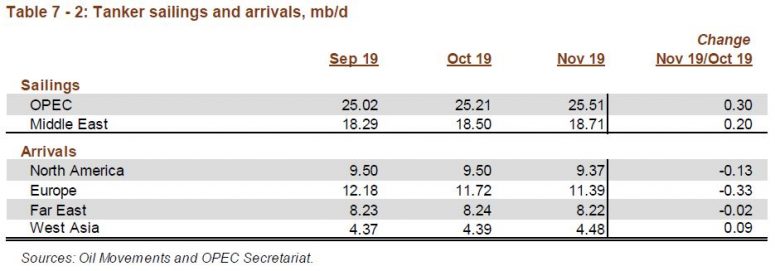

Sailings and arrivals

OPEC sailings rose 1% m-o-m in November to average 25.51 mb/d. Sailings from the Middle East were 1%, or 200 tb/d, higher to average 18.71 mb/d in November. Crude arrivals were largely negative in November. Arrivals in Europe led declines, down 3%, or 330 tb/d, and were similarly lower compared to the same month last year. Arrivals in North America fell 1.4%, or 130 tb/d, and were more than 3% lower compared to the same month last year. Arrivals in the Far East were relatively flat from October, but were almost 10% lower compared to November 2018. The only bright spot was West Asia, where arrivals were 2% higher than in the previous month but were marginally lower compared to the same month last year.

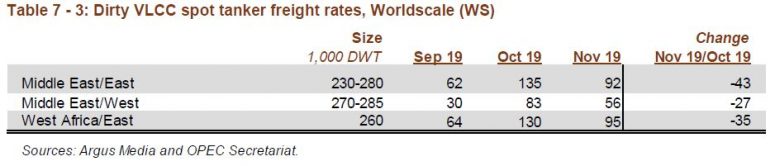

Dirty tanker freight rates

Very large crude carriers (VLCCs)

VLCC spot freight rates fell back in November following the spike in prices seen in the previous month, but were still substantially higher than pre-spike levels. At WS92 points, the Middle East-to-East route was down 32% in November compared to the previous month but some 47% higher than in the September. Y-o-y, rates on the route were broadly in line with those seen in November 2018. Freight rates registered for tankers operating on the Middle East-to-West routes in November were down 33% m-o-m, but were 84% higher than pre-spike levels. At WS56 points, rates on the route were also 37% higher than the same month last year. West Africa-to-East routes in November also showed a similar pattern, down 27% m-o-m, to stand at WS95 points, representing a gain of almost 50% over the levels seen in September 2019 and 4% higher compared to November 2018.

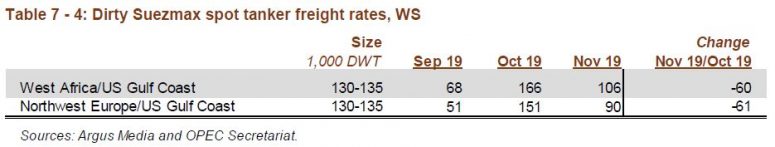

Suezmax

After more than doubling in the previous month, Suezmax average spot freight rates had more room to return some of the gains while still remaining at higher levels compared to levels seen prior to the spike in freight rates. Rates for tankers operating on the West Africa-to-US Gulf Coast (USGC) route averaged WS106 points, representing a m-o-m decline of 36% in November, but 55% higher than the levels seen in September. Y-o-y, however, rates were down 12%. The Northwest Europe (NWE)-to-USGC route declined 40% m-o-m to average WS90 points, which was some 78% higher than pre-spike levels in September 2019, but 11% lower y-o-y

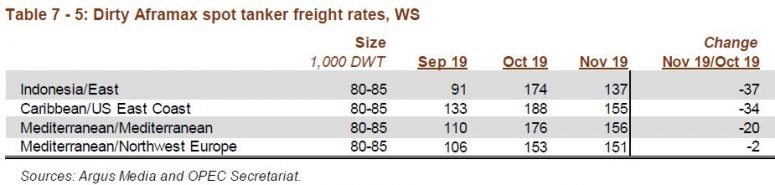

Aframax

The Aframax sector showed a modest improvement compared to the same month last year despite across the board m-o-m declines. The Indonesia-to-East route was 37% lower to average WS137 points, but still represented a gain of 3% y-o-y. The intra-Mediterranean route was down 20% to average WS156 points, while the Mediterranean-to-NWE route shed just 2% to average WS151 points. Both routes, however, saw y-o-y gains of 1% and 5%, respectively.

Only the Caribbean-to-US East Coast route experienced a loss compared to the same month last year. Rates averaged WS155 points, which was 18% lower m-o-m and down 26% y-o-y

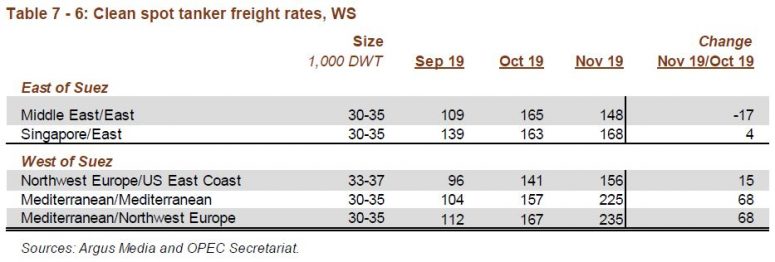

Clean tanker freight rates

The clean spot tanker market enjoyed a positive turn in November, with all but the Middle East-to-East route showing further gains. Clean tanker spot freight rates West of Suez averaged WS205 points, representing an overall gain of 32% over the previous month. The Mediterranean-to-Mediterranean and Mediterranean-to-NWE routes saw increases of around 40% to average WS225 points and WS235 points, respectively. Meanwhile, rates on the NWE-to-USEC route rose 10% to WS156 points. On the East of Suez route, clean tanker spot freight rates edged 4% lower m-o-m in November to average WS158 points, with the Singapore-to-East route increasing 3% m-o-m to average WS168 points, while the Middle East-to-East route declined 10% m-o-m to average WS148 points, which was still 13% higher than the same month last year.

Source : Hellenic Shipping News