Tanker Market In a Tight Spot

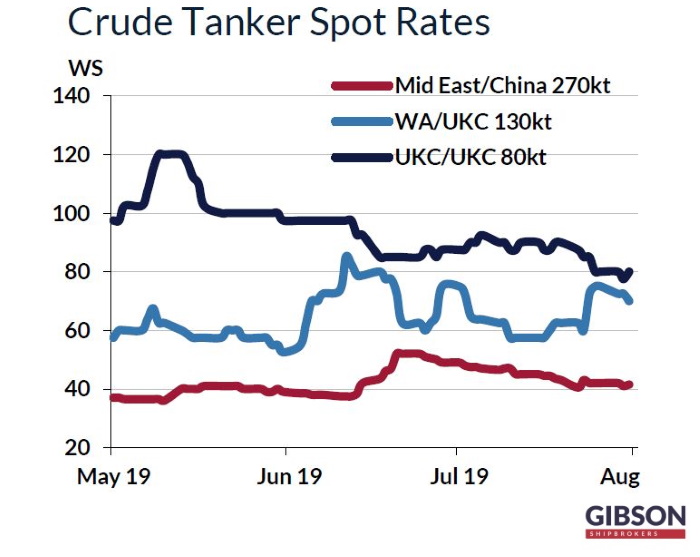

05.08.2019The tanker market is in a perilous place, as the US/China trade war is alive and kicking and world oil demand growth is trending downwards. Product tankers could suffer more, given that a number of oil products are directly correlated to global economic activity. In its latest weekly report, shipbroker Gibson said that “historically, there has been a strong correlation between tanker spot and time charter rates, with period rates tracking (with some time lag) developments in the spot market. However, this year TC and spot values have moved in opposite directions. Spot earnings on benchmark trades gradually cooled over the course of this year, with returns in the clean tanker market reaching in July their lowest level this year. Crude has performed somewhat better, but TCE returns have been weak nonetheless. In contrast, time charter rates have firmed, reaching in July their highest level since 2016/17. The biggest uplift has been seen in 1 and 3 year period assessments for eco VLCCs and LR2/Aframaxes”.

According to Gibson “the downward trend in the spot market has been underpinned by OPEC+ production cuts, extended refinery maintenance, weakness in product demand and plentiful deliveries. In contrast, the ongoing upward movement in the period market has been driven by robust chartering enquiry and positive near term fundamentals, such as a limited tanker orderbook (beyond the 2019 schedule), anticipation of major increases in US crude exports and the approaching IMO 2020, which is expected to lead to incremental trading demand as well as stronger interest for fuel efficient tonnage due to higher bunker costs. Rates for a 3-year TC have also been supported by expectations of notable increases in tanker demolition due to the requirement to retrofit tonnage with approved BWT systems when the deadline comes. Combined, these factors suggested a strong possibility of a market uplift, with limited downside risk”.

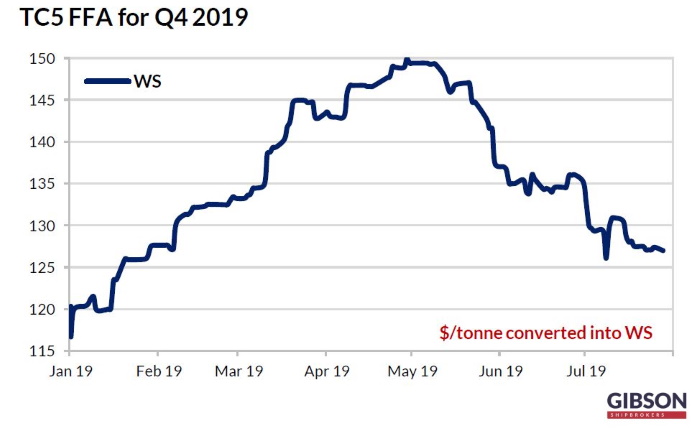

The shipbroker added that “during the first five months of 2019 the same positive trend was witnessed in the tanker forward curve. This year’s fourth quarter $/tonne quotes for TD3C increased by 25% between January and early May, while over the same period a 16% gain was seen in the TC5 forward freight assessment. Thereafter, both TD3C and TC5 were negatively impacted by the breakdown in US/China trade talks and growing concerns about the global economy. Although a partial rebound was seen in VLCC forward assessments since mid-June, $/tonne values for Q4 2019 on TC5 continued to decline, erasing most of the gains observed earlier in the year. As forward freight assessments are a good barometer of the prevailing market sentiment, this suggests that industry participants are generally maintaining a bullish near term view for crude tankers (albeit at a slightly lower level), but forward sentiment for larger product carriers is starting to look increasingly shaky, at least for Q4 2019”.

Gibson added that “without doubt, there are some good reasons for concern. The US/China trade dispute shows no signs of abating. Growth in world oil demand in 2019 has been revised down several times, with product tanker demand more directly exposed to economic indicators. Naphtha, for example, is mainly used as a feedstock in the petrochemical sector and hence there is a direct link with global economic activity. Demand for diesel/gasoil is also largely driven by industrial uses. However, stronger demand for gasoil is still seen due to IMO 2020. Other fundamentals also have not changed. The ramp up of commercial operations at new export orientated refining plants in the Middle East is nearing, although perhaps the start up dates could be pushed back. In terms of fleet supply, the vast majority of the LR2/Aframax and LR1/Panamax tonnage scheduled for delivery this year has already been delivered, while just a few tankers are yet to start trading. As such, there still remains a solid foundation for the market to firm, regardless of the economic turbulence. It remains to be seen what will happen in the end but … the jury is almost out”, the shipbroker concluded.

Source : hellenicshippingnews