Tanker Market Fundamantals Could Turn Positive As Supply Is Down on Most Classes

21.10.2020

Tanker supply is edging near a 5-year low in many segments of the market. This development could bring positive news for tanker owners in the mid-term, which could also help make a case for more investment both in the S&P, but also in the newbuilding market in the coming months.

In its latest weekly report, shipbroker Intermodal said that “the tanker market has experienced severe freight rate and asset value declines over the past 5 months. A potential market upturn may arise in the coming winter period due to the seasonal demand for oil and its derivatives, however, such a boost will likely not suffice in positioning the market towards a recovery phase. With a second COVID-19 wave being potentially imminent, a dampening of crude oil demand may be upon us. A softened importing activity is already being observed in China (the world’s most prominent importer of crude). Chinese imports have been on a slowdown with volumes approaching end of Q1 – start of Q2 levels. Similar import tendencies have been exhibited by other leading importers due to the expectation of a second lockdown”.

According to Intermodal’s SnP Broker, Mr. Timos Papadimitriou, “tanker vessel values have come under significant pressure from the start of the year. With the exception of a few short-lived periods when a high demand for older tonnage due to storage projects was observed, crude ships have seen their values decline year-to-date. Leaving aside the Ocean tanker’s fleet, there is a scarcity of 5 to 10-year-old crude tankers on sale. There is a slightly higher supply of candidates for sale in the 13-16-year-old tanker vessel segment. The question is whether one should invest in a 15-year old crude tanker under a market that shows little signs of recovery. The present-day assumption employed by seasoned shipping veterans is that there is still a long way to go until the tanker market reaches rock bottom”.

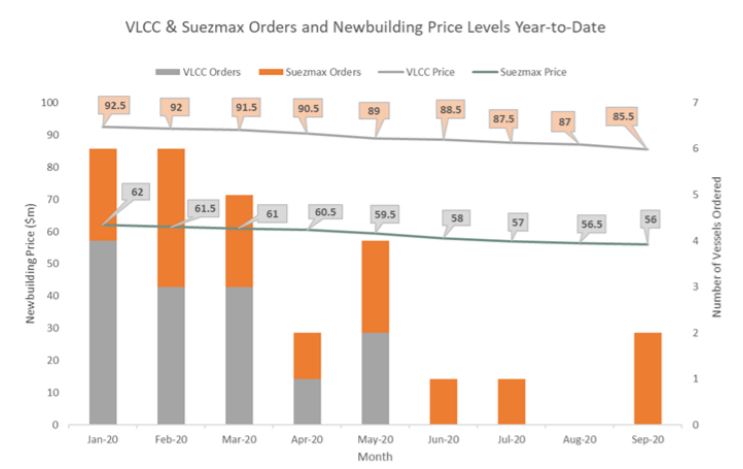

Papadimitriou added that “despite potential long-run returns that an investment in a depressed market may yield, it can be argued that taking a stake in the secondhand market under the current market conditions may not be the only way forward for a shipping company. Present-day VLCC and Suezmax orderbook to fleet ratios are 8% and 9% respectively which are 5-year lows. Moreover, if we factor in demolitions to be undertaken until the end of the year, we could be looking at lower VLCC, Suezmax and crude tanker fleet growths than the already respectively subdued ones of 2.5%, 3.3% and 2.4%”.

“Newbuilding prices placed in Japanese, South Korean and Chinese yards with established track records have significantly decreased since the start of the year. Current VLCC and Suezmax newbuildings come at 8% and 10% price reductions respectively as opposed to January, 2020. Placing a VLCC or Suezmax order may make intuitive sense should the pressure on the tanker market continue to mount while signs of a recovery ahead remain bleak. By placing an order now, one would be allowing for a healthy time leeway for the combating of the pandemic. Despite being in the middle of a global health crisis, the shipping market still holds numerous opportunities in both the newbuilding and secondhand fronts which are awaiting to be exploited”, Intermodal’s analyst concluded.

Source : Hellenic Shipping News