Ships Recycling Market Struggles to Find its Footing

29.08.2019The ship recycling market is struggling to find its footing. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “No demand = No demand! For most of the week the market has remained in a subdued state with Buyers still reluctant to engage or place any offer to the table, however a large LDT dry unit was marketed for sale in the middle part of the week and it seems to have reawakened the Chattogram (Bangladesh) shores, however certainly the later delivery and extensive bunkers ROB included in the sale have helped to obtain this premium.

As this is a later delivery (mid-September – mid October), maybe one cash buyer is speculating on a positive return to the market from the Bangladeshi breakers in time for the arrival of the unit. Whilst reports suggest that there is still a large amount of inventory on the recycling yards in Chattogram – the monsoon rains having hampered the actual cutting process – some of the yards are beginning to empty which therefore may help to bring these recyclers back to the negotiating table. As is always the case with the recycling markets, no demand for steel equates to no demand from the actual ship recyclers. This is certainly the position that we are experiencing during this current trend. In India, it is understood that there are no new projects for infrastructure in place and the real estate market is down, hence the lack of demand for steel which subsequently filters through to the ship recycling industry. Let us hope that we see a turnaround in passion to acquire tonnage in the near future to kick start the market once again”, the shipbroker noted.

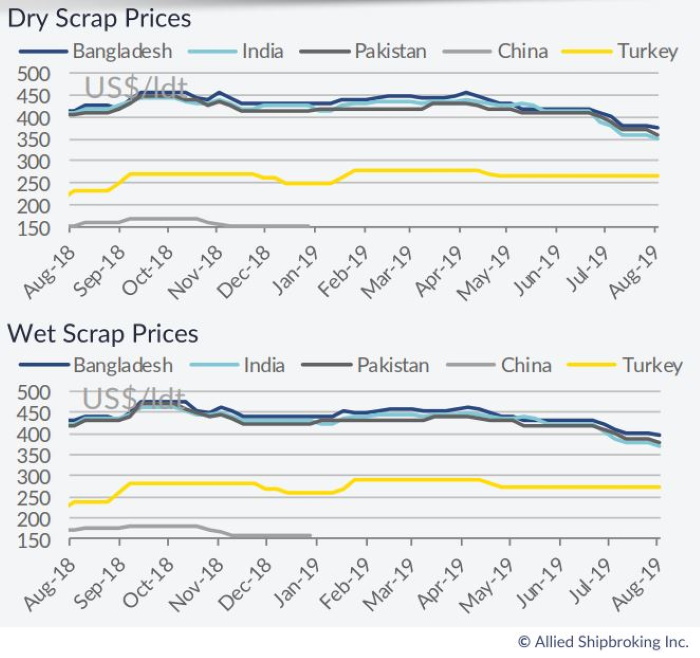

In a separate note, shipbroker Allied said that “despite the end of Eid holidays, activity did not ramp up in the Indian Sub-Continent, with few units being recycled during these past two weeks. In Bangladesh, hopes that cash-buyers interest will intensify again after the holiday period did not materialized. In addition, the monsoon period delayed activity in the region holding back stock and putting extra pressure on local ship breakers. With steel place prices holding steady though, there are many domestic players that expect offered price levels to improve soon, likely attracting more units. Meanwhile, the poor fundamentals and the uncertainty dominating the Indian market has curbed any fresh interest and as such leading to a lack in activity being seen. In addition to unattractive prices, the weaker Indian Rupee has also played its part in the current disappointing demand figures. In Pakistan, despite the few new transactions that came to light during the few past weeks, overall interest for seems to be remaining relatively low. The discouraging price levels and the generally poor conditions prevailing in the local market seem to have delayed any reversal in cash buyers’ appetite for the time being”.

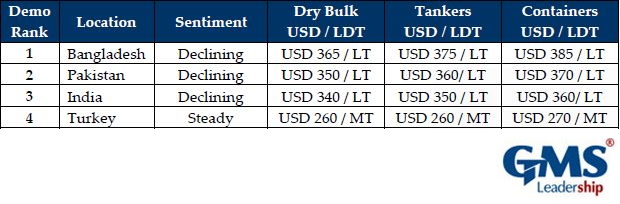

Meanwhile, GMS, the world’s leading cash buyer of ships added that “despite the conclusion of Eid holidays and the ongoing shortage of tonnage in the market, subcontinent locations (especially India and Pakistan) remain stranded around the mid USD 300s/LDT mark. As the ongoing declines over the summer / monsoon months have been notably drastic and significant, going into the fourth quarter of the year, Cash Buyers with expensive, large LDT inventory to offload are still hoping for levels to pick up in Bangladesh, however, the timing of such a recovery remains uncertain. Concerns of a recession in the U.S. amidst trade war jabs with China, in addition to a global fall in steel plate prices have added further negativity to sentiments this week and there remains a great degree of hesitation from end Buyers to engage in negotiations / offer firm numbers (especially until some sort of sensible stability is seen). Levels in India have been hit the hardest by the dual dilemmas of collapsing steel plate prices and a depreciating currency. Pakistan too is not far behind, albeit, not for anything other than mirroring its nearest competitor’s pricing, as both compete for the dubious honor of being the lowest placed subcontinent market for anther week. Bangladeshi Buyers have been off on Eid holidays over the past week and it is hoped that it should be another week or so before activity starts to pick up again. Nevertheless, many yards remain stuffed with large LDT inventory beached here during the early part of the year, most of which has struggled to shift over the recent months due to the constant rains. Finally, Turkey’s frozen summer session continues unabated, with reportedly no change in Turkish plate prices, although the currency did weaken a shade this week, making matters unapologetically worse for Turkish Recyclers”, GMS concluded.

Source : Hellenic Shipping News