Ship Owners Starting to Make Waves in the Market

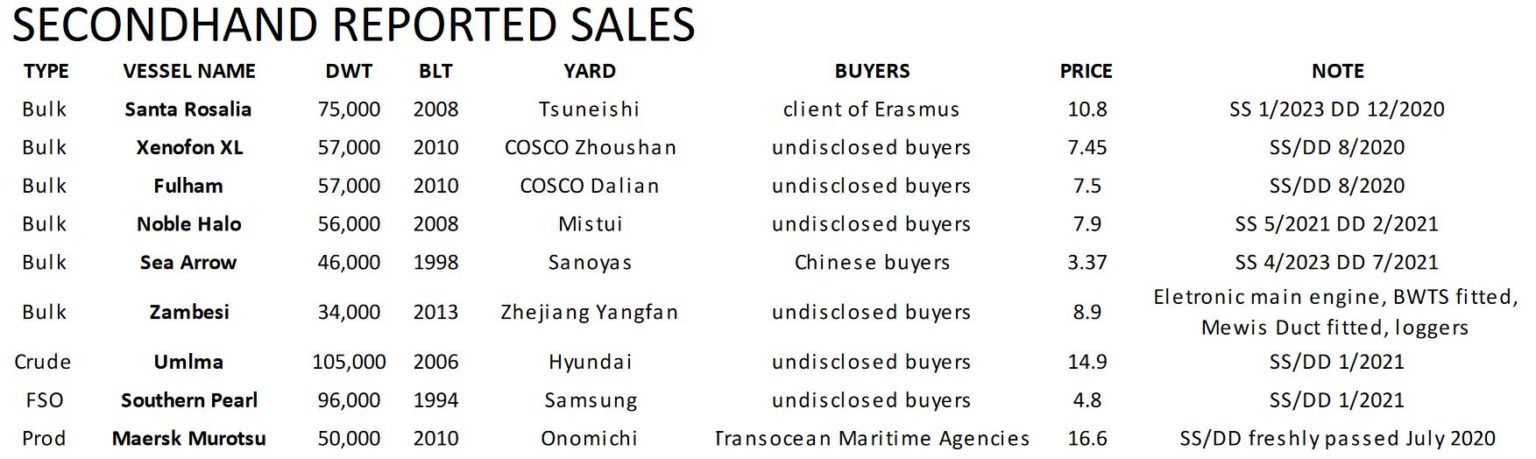

31.07.2020 Ship owners have been rather active both in the newbuilding and the second hand market for ships over the past week. In its latest weekly report, shipbroker Banchero Costa said that “several sales took place in the dry segment during the week although several countries such as Singapore, Hong Kong, etc. imposed stricter rules for crew change and this may affect future transactions. S Korean controlled Kamsarmax bulker “Wise Young” 82,000 dwt built in 2011 at Daewoo with SS/DD due in November (out-of-sync) 2020 will end up in Greek hands for $13.5 mln. Supramax bulkers of 57,000 dwt “Xenofon XL” and “Fulham” both built in 2010 at COSCO Zhoushan and COSCO Dalian respectively were sold for $7.5 mln each; similar levels were achieved by two years younger units built in Japan, Supramax “Noble Halo” 56,000 dwt built in 2008 at Mitsui – reportedly sold to undisclosed buyers for $7.9 mln. In the Handysize segment, “Zambesi” 34,200 dwt built in 2013 at Zhejiang Yangfan, China was sold at $8.75 mln (BWTS installed) whilst “Ikan Jenahar” 32,000 dwt built in 2010 at Saiki was also sold but no price emerged yet. It is worth noticing that the demolition market steadily picked up and couple of bulk carriers have now managed to achieve levels in excess of $350 per LDT. In the tanker segment, despite a persistent soft market and summertime, there were still various negotiations around with buyers looking for bargain deals. A 20 years old VLCC ‘Bag Meur’ 306,000 dwt built at Hyundai with SS/DD due in August was sold to undisclosed for $23.5 mln. Aframax ‘Umlma’ 105,000 dwt built in 2006 at Hyundai reportedly achieved $14.9 mln, a new (lower) benchmark for this size/age. Finally MR2 ‘Maersk Murotsu’ 50,000 dwt built in 2010 by Onomichi was purchased by European buyers at $16.6 mil, basis 2nd Special Survey freshly passed”.

Ship owners have been rather active both in the newbuilding and the second hand market for ships over the past week. In its latest weekly report, shipbroker Banchero Costa said that “several sales took place in the dry segment during the week although several countries such as Singapore, Hong Kong, etc. imposed stricter rules for crew change and this may affect future transactions. S Korean controlled Kamsarmax bulker “Wise Young” 82,000 dwt built in 2011 at Daewoo with SS/DD due in November (out-of-sync) 2020 will end up in Greek hands for $13.5 mln. Supramax bulkers of 57,000 dwt “Xenofon XL” and “Fulham” both built in 2010 at COSCO Zhoushan and COSCO Dalian respectively were sold for $7.5 mln each; similar levels were achieved by two years younger units built in Japan, Supramax “Noble Halo” 56,000 dwt built in 2008 at Mitsui – reportedly sold to undisclosed buyers for $7.9 mln. In the Handysize segment, “Zambesi” 34,200 dwt built in 2013 at Zhejiang Yangfan, China was sold at $8.75 mln (BWTS installed) whilst “Ikan Jenahar” 32,000 dwt built in 2010 at Saiki was also sold but no price emerged yet. It is worth noticing that the demolition market steadily picked up and couple of bulk carriers have now managed to achieve levels in excess of $350 per LDT. In the tanker segment, despite a persistent soft market and summertime, there were still various negotiations around with buyers looking for bargain deals. A 20 years old VLCC ‘Bag Meur’ 306,000 dwt built at Hyundai with SS/DD due in August was sold to undisclosed for $23.5 mln. Aframax ‘Umlma’ 105,000 dwt built in 2006 at Hyundai reportedly achieved $14.9 mln, a new (lower) benchmark for this size/age. Finally MR2 ‘Maersk Murotsu’ 50,000 dwt built in 2010 by Onomichi was purchased by European buyers at $16.6 mil, basis 2nd Special Survey freshly passed”.

In a separate note, Allied Shipbroking said that “on the dry bulk side, after the tremendous rally in total activity noted during the past week or so, things slowed down considerably over the last few days. The week closed off with but a handful of units changing hands in the meantime. At this point, we saw volume being concentrated in the medium and smaller size segments, given the hefty negative corrections in freight returns noted in the larger sizes. Hopefully, even if we are in the midst of a sort of correction from the side of earnings, buying appetite will should be sustained at relatively good levels for the near term at least. On the tankers side, little has changed in terms of volume of transactions being noted during the past week or so. It seems that we have already entered a sluggish period in terms of buying appetite. Moreover to this, given the considerable pressure being noted in terms of earnings as of late, this mediocre appetite may well be sustained in the near term”, Allied said.

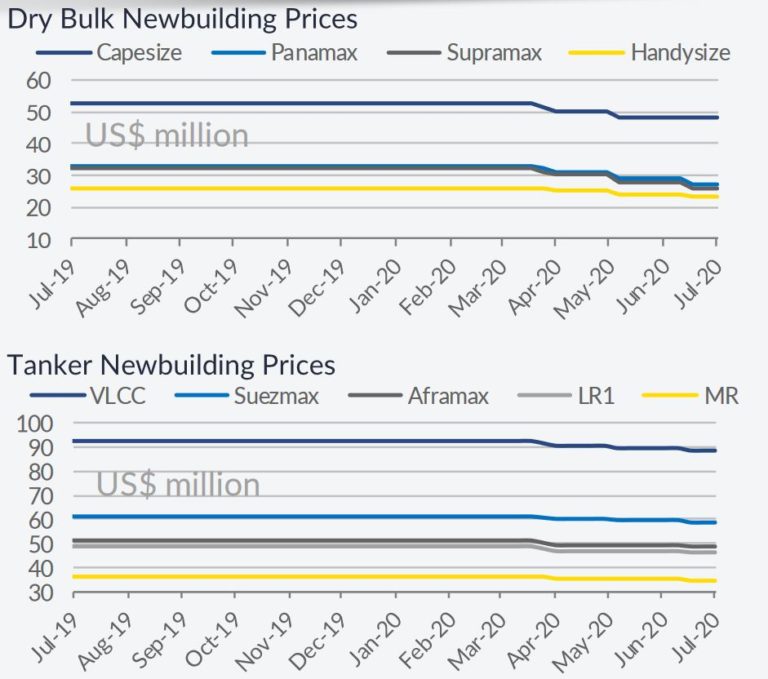

Meanwhile, in the newbuilding market, Banchero Costa said that “interest was focused on the tanker segment. A new joint venture company composed by ECCO Holding A/S, Gunvor and Dee4 Capital Partners signed 2 + 2 MR2 (50,000 dwt) with Hyundai Mipo with delivery starting from beginning of 2022. Furthermore, Hyundai Mipo received confirmation of order from Benelux for 2 + 1(option) MR2 at $35.7 mln each. In China, Eastern Pacific singed LOI for 5 x dual fuel Newcastlemax units (208,000 dwt) with New Times Shipyard. Vessels to be backed by long term (5 years) TC to BHP, Australia and Vessels cost to be around $66 mln each. Deliveries starting from Q1 2022”.

Allied added that it was “a fairly active week for the whole newbuilding market, given the fair number of new orders being concluded across most of the main sectors. In the dry bulk market, we witnessed a strong push in the bigger size segments, despite somehow the recent steep negative corrections noted from the side of freight earnings. On the tanker side, we are currently seeing a keen interest towards different size segments. This may have caught some by surprise, given both the recent slowdown in the SnP market activity for relatively similar size units, as well as, the downward correction that has be noted for some time now in terms of freight returns. Notwithstanding this, given the general uncertainty since the onset of the pandemic and the fact that we are already well in the midst of the summer period, it is highly unlike that we will see this trend noted of late to continue on a similar pace. However, if we assume a continuous improving sentiment, the fact that greater opportunities can be had now in terms of pricing and early slots, potential buyers could well be enticed for a second and more amplified round of newbuilding ordering over the course of the second part of the year”.

Source : Hellenic Shipping News