No Respite for Tanker Owners Until the Second Half of 2021

12.03.2021 All hope for the tanker market’s recovery is rested on the second half of the year, when oil demand is expected to rebound considerably.

All hope for the tanker market’s recovery is rested on the second half of the year, when oil demand is expected to rebound considerably.

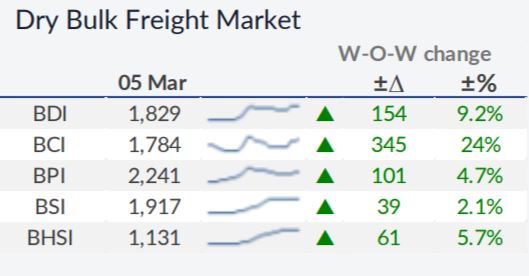

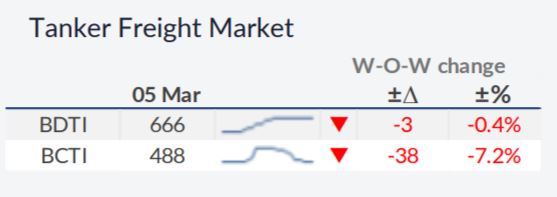

In its latest weekly report, shipbroker Allied Shipbroking said that “the uninspiring freight scene in the crude oil tanker market has persisted for a very long period and owners with their vessels trading mostly in the spot market have seen a significant accumulation in negative earnings. The average Baltic indices for all crude oil size segments have remained below OPEX levels for several months now, while they have not climbed above US$20,000 since the summer of 2020. The slower than expected recovery in global demand and the lower overall global mobility taking place has led trade in crude oil and petroleum products at significantly reduced levels”.

All hope for the tanker market’s recovery is rested on the second half of the year, when oil demand is expected to rebound considerably.

In its latest weekly report, shipbroker Allied Shipbroking said that “the uninspiring freight scene in the crude oil tanker market has persisted for a very long period and owners with their vessels trading mostly in the spot market have seen a significant accumulation in negative earnings. The average Baltic indices for all crude oil size segments have remained below OPEX levels for several months now, while they have not climbed above US$20,000 since the summer of 2020. The slower than expected recovery in global demand and the lower overall global mobility taking place has led trade in crude oil and petroleum products at significantly reduced levels”.

Allied’s analyst concluded that “this may lead to slower imports moving forward, as demand growth will be counterbalanced by the already built-up inventories. In Europe, the latest forecasts are showing a rise of gasoline demand during January, given the increased mobility noted, but at much lower levels compared to the respective figure of 2020. In addition to gasoline, jet fuel demand is also growing at a slow pace, with commercial flights in Europe still at less than half their 2019 levels. Demand is almost certain to post an annual growth this year, with the crucial part of the rebound though being now estimated for the second half of the year.

The IEA has stated that global consumption of oil and its products in 2021 will rise by 5.4 million b/d, while OPEC is more optimistic estimating a rise 5.8 million b/d for 2021. Therefore, pressure on freight earnings is likely to hold in the coming months, with all attention now turning to the second half of year where most of the optimism and hope for the market now lays”, the shipbroker said.

Source:Hellenic Shipping News