Lack of Tonnage Prevalent in the Demolition Market

04.03.2021 Alack of tonnage is becoming evident in the ship recycling market, as the firming up of the freight market has limited selling opportunits among ship owners. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “with owners still enjoying the fruits of the continued firm freight markets, particularly in the dry sector, the alarming lack of tonnage in the market gives a barren feel to discussions. There seems to be no stimulus at present, with the industry crying out for a spark which could ignite a flurry of transactions. The only glimmer of hope is that tanker rates continue in the doldrums and are the lowest seen for over twenty years, which is why many are surprised we have yet to see a large uptake in candidates flooding the recycling shores. It is therefore hoped that the tide could turn quickly in the coming months ahead when finally, these vintage wet units are disposed of. Fortunately, we are also starting to see some recovery from the Covid pandemic crisis as economies around the world start to rebuild. This in turn should aide infrastructure and building, which will ramp up steel demand globally and increase prices. We could therefore start to see steel mills locally in the various recycling locations to inflate their prices as they start to seek more scrap steel to meet demand and in turn, we should naturally see a rise in rise ship plate prices going forward. As the lack of tonnage supply takes hold, certainly indications for recycling will pick up”.

Alack of tonnage is becoming evident in the ship recycling market, as the firming up of the freight market has limited selling opportunits among ship owners. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “with owners still enjoying the fruits of the continued firm freight markets, particularly in the dry sector, the alarming lack of tonnage in the market gives a barren feel to discussions. There seems to be no stimulus at present, with the industry crying out for a spark which could ignite a flurry of transactions. The only glimmer of hope is that tanker rates continue in the doldrums and are the lowest seen for over twenty years, which is why many are surprised we have yet to see a large uptake in candidates flooding the recycling shores. It is therefore hoped that the tide could turn quickly in the coming months ahead when finally, these vintage wet units are disposed of. Fortunately, we are also starting to see some recovery from the Covid pandemic crisis as economies around the world start to rebuild. This in turn should aide infrastructure and building, which will ramp up steel demand globally and increase prices. We could therefore start to see steel mills locally in the various recycling locations to inflate their prices as they start to seek more scrap steel to meet demand and in turn, we should naturally see a rise in rise ship plate prices going forward. As the lack of tonnage supply takes hold, certainly indications for recycling will pick up”.

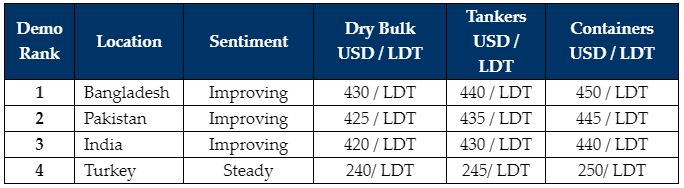

Meanwhile, Allied Shipbroking added in a report this week that “given the positive momentum noted in the dry bulk and container-ship freight earnings, it comes as no surprise that ship recycling activ-ity has remained relatively subdued as of late. The estimated DWT capacity that has been scrapped in the year so far is 4.7 million. However, as steel prices have started to improve, breakers are likely to entice owners of these segments to begin considering the scrap-ping option once again. Meanwhile, the tanker market is still a poten-tial source of demolition candidates, as market fundamentals there are much weaker, though activity is still scarce for the time-being. In Bangladesh, the last few weeks have not been very active, but as local breakers have started to regain their competitiveness, given the improved offered prices, it is expected that enquiries should start to increase sooner or later.

In India, HKC units are still the main source of activity, as demand overall has lost some ground compared to the rest of the Indian Sub-Continent. The current offered price levels and the weaker Indian Rupee has trimmed interest for the time being, and it is questionable if this can reverse in the following weeks. In Pakistan, the rise in local steel prices resumed for yet another week, allowing local breakers to boost their offered prices in an attempt to regain some of the previously lost market share”, Allied said.

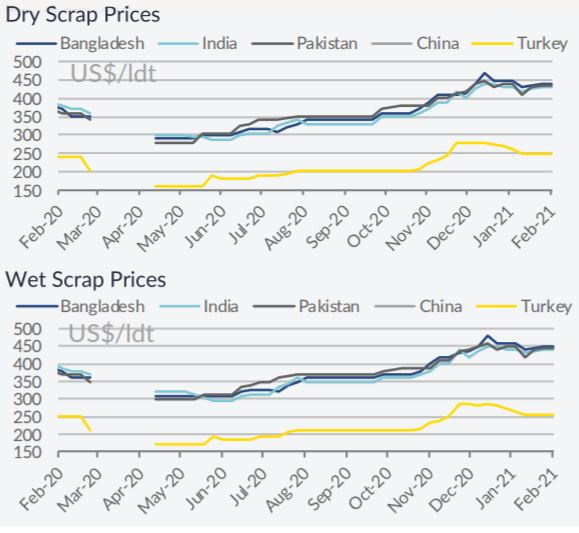

In a separate report this week, GMS , the world’s leading cash buyer of ships, said that “as the decline in steel plate prices levels out for the time being, all of the sub-continent markets are in a far healthier position today than they were only a few weeks back. The halt was perhaps expected, given the resumption of buying from Chinese mills, now that the Chinese New Year holidays are finally over. Consequently, we have seen prices come up of late and almost all of the sub-continent markets are now trading in the mid USD 400s/LDT, having only recently been in the low USD 400s/LDT (and even below) for many of the units that were being discussed basis a February (Alang) delivery. Therefore, the sub-continent markets can positively head into March, poised and ready to acquire units at decent levels once again. Demand remains good across all sub-continent locations, but of course there is a distinct lack of supply with most freight sectors performing well of late. At the far end, even the Turkish market is doing better as fundamentals have been improving and prices start to firm. Only a matter of time until yard space starts freeing up and levels jump even higher.

On another note, Dr. Anand Hiremath, the lead coordinator of GMS’s SSORP (Sustainable Ship and Offshore Recycling Program) has an article published this week in Lloyds List, which details the carbon footprint expended during the recycling process of each vessel. His findings state that the carbon footprint from steel retrieved from ship recycling in India is nearly four times LESS than the carbon footprint of the world’s best steel production from iron ore. Ship recycling therefore is clearly a far greener way to re-use steel without emitting greenhouse gases into the atmosphere. The recent announcement in the Indian budget to double ship recycling capacity by 2024 is promoting a sustainable way for the country to satisfy its steel needs, whilst providing economic stimulus in the form of job creation and helping the country to fight climate change and meet its international obligations on emissions”, GMS concluded.

Source : Hellenic Shipping News