Dry bulk trade in 2020: continuing sluggish growth?

24.01.2020 A further slowing of global dry bulk trade growth momentum unfolded last year. Estimates suggest that in 2019 as a whole growth was weak, below the previous year’s increase. Signs point to a similar outcome – a weak increase – in 2020. Although predictions typically involve much guesswork, there are clear indications of restraints on seaborne cargo movements which probably will prevent a brisker pace returning.

A further slowing of global dry bulk trade growth momentum unfolded last year. Estimates suggest that in 2019 as a whole growth was weak, below the previous year’s increase. Signs point to a similar outcome – a weak increase – in 2020. Although predictions typically involve much guesswork, there are clear indications of restraints on seaborne cargo movements which probably will prevent a brisker pace returning.

Views differ, and some pundits are more upbeat. Reputable analysts have recently forecast quite robust growth in the twelve months ahead and, moreover, for several years ahead. It may not be a good idea to dismiss these suggestions entirely, given the unreliable nature of past forecasting, which was regularly confounded by surprises. Nevertheless, based on current signs, a set of circumstances resulting in robust dry bulk trade expansion during 2020 seems unlikely.

Outlook overview

As the year begins growth in grain and soya trade, and among the wide range of minor bulk commodity trades, is foreseeable at moderate rates. By contrast in the iron ore and coal trades, together comprising just over half of the dry bulk trade total, positive influences which could provide an uplift are not so obvious, while potential restraints are visible. The outcome in 2020 could be flat or reduced annual volumes in these two categories.

Numerous influences are likely to limit dry bulk trade growth during the next twelve months. Although the possibility of a global economic recession has receded, the world’s economic growth rate remains sluggish – adversely affecting demand for the products of industries consuming and importing dry bulk commodities – and there are no signs of an early or robust upturn.

International trade tensions may persist even after an interim resolution of the US-China dispute. In China the economy appears to be still on a long-term slowing trend, amid a maturing and rebalancing process, restricting commodity import demand. One major part of world dry bulk trade, coal and especially steam coal, is experiencing sustained downwards pressure from environmental policies in many countries, aiming to promote cleaner energy supplies.

Consequently it seems realistic to envisage that overall world dry bulk commodity trade will grow by no more than about 1% in 2020, similar to last year’s estimated performance. A higher 2% growth rate is not outside the range of ‘reasonable’ forecasts, but reaching that pace requires several major elements to develop more strongly than presently seems predictable.

Higher forecasts of 3.5-4% expansion in 2020 imply that the restraining influences, which are prominent and look set to continue, will dissipate. Two forecasters publishing such calculations recently also predicted sustained average expansion at this pace over the following three or four years. That idea seems even less convincing, amid clear signs of potential negative and constraining pressures

How has the global trend evolved?

Reviewing briefly what has happened, over the past decade, shows some changes in the pace of global seaborne dry bulk commodity trade which may have implications for the future trend. A decade ago in 2009 and 2010 an unusually large trade downturn and rebound followed the global financial crisis of 2008 and its aftermath, an exceptionally severe world recession. Since then, an upwards trend has been sustained, with an increase in dry bulk trade in every year except one, at varying growth rates of between 1% and 6%.

During the four years from 2011 to 2014, immediately after the exceptional changes occurring previously, rapid expansion of global seaborne dry bulk trade growth was seen, at rates close to 6% in each year, averaging 5.8%, based on Clarksons Research data. This vigorous enlargement was followed by much slower progress. In the next four years, from 2015 to 2018, growth varied widely between almost nil (0.2% in 2015) and a robust 4.1% in 2017, with an average 2.1% annual rate.

Looking at the pattern of annual changes in the latest three years, 2017-2019, shows a continued deceleration. From the 4.1% rate in 2017, growth slowed to 2.7% in 2018 and an estimated 1% in 2019. This sharp slackening, and evolving awareness of its explanations, has provided an incentive to reconsider the potential direction and magnitude of changes in the period ahead. Two influences being scrutinised especially closely are the pace of China’s dry bulk imports, and the negative pressures affecting global steam coal usage and import demand.

China’s dry bulk imports

The salient features of China’s dry bulk cargo imports merit discussion. First, these imports of iron ore, coal, grain and soya, and many other commodities now comprise one-third of the world dry bulk trade total. Second, a large part of the growth in global dry bulk trade during the past decade reflected additional imports into China: these contributed over half (55%) of all world growth in dry bulk commodity imports.

It is clear that the upwards world dry bulk trade trend is highly dependent on rising Chinese imports. Any faltering of the China trend has substantial negative implications for the overall pattern. There are no other areas around the world where import demand expansion might fully compensate for loss of momentum in China’s volumes, if that occurs during the next few years.

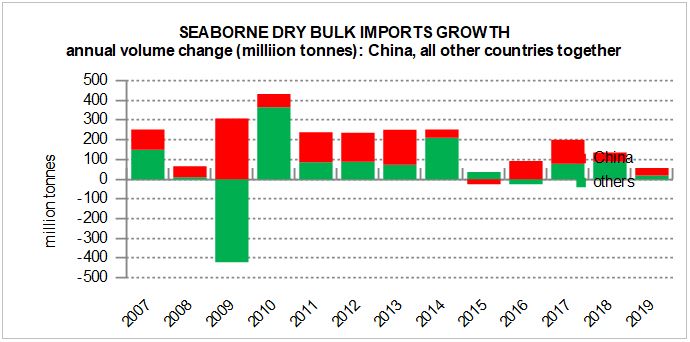

In the chart below China’s contribution to annual increases in world dry bulk trade is emphasised. The bars show imports growth in each year, from the previous year, by (a) China, and (b) all other importing countries together, in million tonnes. These figures are based on Clarksons Research data and Bulk Shipping Analysis calculations, with BSA estimates for the past twelve months. The red portions of the bars emphasise how much of the global volume increase in each year was derived from China’s additional imports.

World and China changes

Patterns evolving in global seaborne dry bulk trade in the past nine years, from 2011 to 2019, are of particular interest. This period excludes the two previous years when dramatic distortions were experienced. In 2009, a large increase in China’s dry bulk commodity imports was more than offset by a huge reduction in imports by the rest of the world, resulting in global dry bulk trade declining. In the following year, 2010, there was a vigorous world rebound.

Because 2009 and 2010 saw unusually large trade disruption, these years are not useful to include in the trend analysis. In the 2011 to 2019 period, world seaborne dry bulk trade grew cumulatively by 1446 million tonnes, reaching an estimated 5281mt in 2019. Within the overall growth, China’s imports increase was 791mt, or 55% of the total 1446mt increase.

It is also useful to look at a shorter period of the past three years, to see whether there have been any recent changes which could modify views of possible implications for the future trend. During the 2017 to 2019 period, world dry bulk trade grew by a cumulative 392mt, averaging 2.6% annually. Within this performance China’s increase was 207mt, a 53% share of the total world expansion. This result is similar to the calculation for the longer period.

Prospects for 2020 suggest that additional import demand for dry bulk commodities in China will prove limited. Since the extra volumes in recent years have contributed more than half the world total, this expectation of a weaker performance implies a notable restraint on the upwards trend in the global volume.

Global economy permeations

Underlying the dry bulk commodities trade trend, with a direct and visible impact on numerous individual trade movements, is the world economy’s progress. The pace of economic activity in countries which are substantial importers of these cargoes is a major driver. Macro-economic changes, affecting demand for the products of industries using imported dry bulk commodities, is an aspect closely monitored.

At the beginning of 2020, there are only minimal signs of a global pickup in economic growth during the year ahead. An easing of international trade tensions could contribute, but other signs are not promising. A recent forecast by the OECD organisation envisaged no strengthening this year from the reduced 2.9% world gross domestic product growth rate estimated for 2019. This expectation of continued subdued growth was attributed to “trade conflict, weak business investment and persistent political uncertainty”.

None of the biggest economies influencing dry bulk commodity trade is expected (by the OECD) to achieve an improved GDP growth rate in 2020. The USA, European Union, Japan and China are all predicted to see slowing this year. In China “the economy is structurally changing, rebalancing away from exports and manufacturing towards more consumption and services…China’s traditional contribution to global trade growth is set to slow and change in nature” according to OECD analysts.

Commodity conundrum

Slow economic growth is affecting global steel production, with output in raw materials (mainly iron ore and coking coal) importing countries of particular relevance. The most significant are China, EU, Japan, South Korea and India. In these countries meaningful increases in steel output in 2020 probably will be hard to attain, although India’s steel demand and production trend may strengthen. China was an exception to the general pattern last year, with substantially higher steel output, but an upwards trend may not continue.

Iron ore trade, estimated at about 1425mt in 2019, comprising 28% of the world dry bulk trade total, may have limited or even no potential for further expansion. China’s imports (over two-thirds of global iron ore movements) could have reached a peak as, within the range of influences which propelled the upwards trend, signs of a sustained boost are absent. In the next few years a rising proportion of scrap used in the steel production process in China could replace some iron ore, a negative aspect. Among other iron ore importers positive indications are not prominent.

In the coal segment, trade in which is estimated at about 1280mt last year, comprising 24% of world dry bulk trade, the biggest part is steam coal contributing four-fifths of the total. In some countries, especially India and a group of Asian smaller importing countries, steam coal imports are still increasing. But this positive category contrasts with downwards pressures exerted on imports in many other countries around the world, where environmental policies and the shift towards cleaner energy sources are reducing coal’s role.

Prospects for enlargement seem to be better in the grain and soya trade, and within the minor bulks segment including a widely diversified range of commodities. Together these comprise the remaining 48% of global dry bulk trade. Last year’s volumes are estimated at 485mt and 2080mt respectively.

Grain and soya trade prospects have improved recently. Stronger import demand for wheat plus corn and other coarse grains, in a number of countries, is forecast by the International Grains Council during the 2019/20 crop year ending June. The world total could be 3% higher at 375mt. Global soyabeans and meal trade in the year ending September 2020 is forecast by the US Department of Agriculture at 213mt, a 2% increase amid strengthening demand in several areas around the world.

The minor bulks segment is vast and varied, with industrial as well as agricultural commodities included, making generalisations difficult. In some commodity trades adverse effects from slow economic growth patterns are evident while in others, clear signs of positive influences providing a boost are visible. One positive part is trade in the aluminium industry raw materials – bauxite and alumina – which is likely to continue expanding rapidly.

China’s participation in all the commodity segments is substantial, in varying proportions. In iron ore Chinese buyers dominate, hence the evolution of world trade in this commodity is heavily dependent on this country’s changing and possibly no longer increasing import demand. For other commodities, dependence on China is not so great but it is still large, and there is potential for big changes in volume from one year to the next. These changes, which may be rises or falls, could result at least partly from government policy decisions which are not always predictable.

Gazing into the crystal ball

Typically the outlook for dry bulk trade, even in the near-term future of the twelve months ahead, is a puzzle, reflecting many imponderables. Despite the increased sophistication of forecasting techniques and analysis, many influences around the world remain difficult to predict except as general ideas and possibilities shaping trends. A constant process of revising and updating forecasts is necessary as events unfold.

Analysis of the separate segments of dry bulk trade – iron ore, coal, grain and soya, and minor bulks – and the specific influences affecting the trend in each, arguably points to around 1% growth in the global seaborne dry bulk trade total in 2020. As a range, 0-2% may be considered as a realistic expectation. But some forecasters are much more optimistic, suggesting that the growth rate this year could be double this calculation.

Last month a published maritime consultancy forecast showed that world seaborne dry bulk trade could grow by 3.7% in 2020, after an estimated 4.5% increase in 2019. This forecaster’s optimism extended over the five years ahead, with an average 3.7% annually (the same as the figure for this year) expected during the 2020-2024 period.

A couple of months earlier the United Nations Conference on Trade and Development (UNCTAD) had made a similar medium-term forecast in its annual review. According to this organisation’s calculations, world seaborne dry bulk trade could increase by 3.9% annually in the period 2019-2024. Although not specifically forecasting a 2020 growth rate, the average annual growth rate suggested could be interpreted as implying a relatively high expansion in the current year.

Arguably such short- and medium-term projections are too optimistic. A 4% growth rate certainly was seen as recently as 2017; however, it was seen for only one individual year. And it was far higher than seen in any other of the past five years – 2015 to 2019 (including a partly guessed 2019 outcome) – which averaged about 1.9%. This lower figure seems a much better guide to likely future progress.

Extrapolations of current or recent growth rates can prove misleading though. In the history of dry bulk trade, there are examples of periods where reliance on recent years’ performances for guidance on the future trend would not have provided valuable indications.

In the present context, actual or potential longer-term restraining influences have become clearer within the past couple of years, those affecting coal trade and also China’s dry bulk imports in particular. New circumstances have prompted a reevaluation of the trend potential, a fundamental reassessment. It now seems reasonable to envisage a 0-2% annual growth rate range for global seaborne dry bulk trade as more likely than a 3-4% range.

Source : Hellenic Shipping News