Dry Bulk Market: Is the Momentum Sustainable This Time Around?

18.05.2021

Despite last week’s setback, the dry bulk market continues to impress with its strong trajectory since the onset of this year. In its latest weekly report, shipbroker Allied Shipbroking said that “now, reaching close to halfway through the 2nd quarter of the year, the current orbit in freight earnings is far from just an “atypical” bullish start, pushing somehow many market participants to become even more enthusiastic and “hungry” for fresh business opportunities. So, in a steadily rising market, what are the dangers and risks ahead that could potential derail the current status quo?”

Thomas Chasapis, Research Analyst with Allied said that “I would personally suggest that a state of disconnected or asymmetrical movement of core variables could theoretically trigger a fair collapse of the current momentum. The question is though whether we can see any sort of disconnect present at this point. The solid performance in freight rates is the backbone of the current positive sentiment. Spot returns indicate a robust trajectory, especially when given how quickly the market recovered from the pressure noted in the early part of April”.

“Now that the Capesize in on a steep upward rally (the BCI 5TC has already reached above the US$ 40,000/day mark), it is possible to see another strong push in overall returns in the dry bulk sector. The period market has also had an impressive rally, climbing to its strongest figures in over 5 years, while in many cases and mostly for 12month period TC numbers, we are at the highest levels seen in a decade. Someone could argue that these levels are prone to shift along changes in the spot market, however, given the increased volume seen in period fixtures this already “guaranties” a more stable scene in realized earnings for a longer period of time than spot returns could otherwise “suggest”. For many, the “go to market” as a longer perspective indicator is the SnP. During the 2nd half of 2020 we witnessed a prolonged stagnation in terms of asset price levels”, Chasapis said.

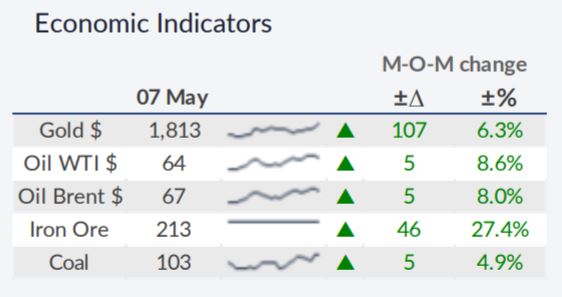

“At that time, the balance in asset prices was fairly inline with respective 5yr average figures, amidst a recovering freight environment. In retrospect, mean-reverting approach taken by many may have been a reflection of the cautionary tone taken by most in the market at the time. Move onto 2021 and the perception and behavior has completely shifted, with asset prices now being at 5-year highs across all the different age groups and size segments, highlighting the high expectations in terms of what most expect to take place next. We have mentioned in previous insights, that for the time being at least, the current freight levels, commodity trends, macro-economic environment and price momentum continue to firmly support the idea of stronger asset price levels”, he noted.

Allied’s analyst added that “however, is there any underlying catch? It seems too early to say, but noticing a similar upward trend in asset price levels in the tanker sector, while their respective returns have held at rather uninspiring levels for almost a year now, seems to leave hints of a possible exaggeration at play. This could be driven mostly by a general increase in financial investment appetite, something that may well prove not to be in favor of an upward continuation of this trend across a medium and long term basis. All-in-all, it seems that the core indicators in the dry bulk sector are moving attuned in terms of the general positive trend. Notwithstanding this, long term sustainability and stability in any market comes when all variables not only move in the same direction, but also align in terms of pace. Otherwise, there is great risk of putting in jeopardy “healthy” macro trends in favor of higher short-term performance”, he concluded.

Source:Hellenic Shipping News