Demolition Market Off to a Good Start

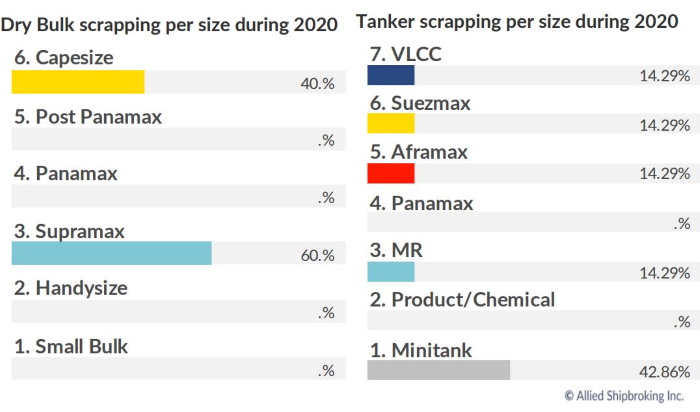

29.01.2020 Ship owners have been more active in the demolition market this week, as freight rates have retreated in most markets, triggering an exodus of older units. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “it would appear that many more vessels are being talked around the market with Owners starting to consider options for their vintage units, especially as they start to adjust themselves to the IMO 2020 regulations and look for business opportunities. This has been further prompted by the Baltic dry index which has destabilized this week, especially in the Capesize sector, which has generated more enquiry from Owners as recent sales also catch their eye and turn their attentions to the recycling industry. This has helped the positive sentiment to continue as the market looks to gather further momentum after what has been a bright start to the year, with many predicting an active year once again after a disjointed 2019. There have been various rumours abound this week concerning the amount of large dry units coming for sale (i.e. Capesize, VLOC’s), however it has been discovered on closer inspection that the majority of these ‘supposed’ units are actually not fully workable at this current time. But it does give an indication for what is to come and what will be the story for the market this year, which is most likely tonnage from the dry sector funnelling itself into the arena. The concern will be having all the units working officially at the same time which will inevitably bring a question mark over the current firm indications”, the shipbroker noted.

Ship owners have been more active in the demolition market this week, as freight rates have retreated in most markets, triggering an exodus of older units. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “it would appear that many more vessels are being talked around the market with Owners starting to consider options for their vintage units, especially as they start to adjust themselves to the IMO 2020 regulations and look for business opportunities. This has been further prompted by the Baltic dry index which has destabilized this week, especially in the Capesize sector, which has generated more enquiry from Owners as recent sales also catch their eye and turn their attentions to the recycling industry. This has helped the positive sentiment to continue as the market looks to gather further momentum after what has been a bright start to the year, with many predicting an active year once again after a disjointed 2019. There have been various rumours abound this week concerning the amount of large dry units coming for sale (i.e. Capesize, VLOC’s), however it has been discovered on closer inspection that the majority of these ‘supposed’ units are actually not fully workable at this current time. But it does give an indication for what is to come and what will be the story for the market this year, which is most likely tonnage from the dry sector funnelling itself into the arena. The concern will be having all the units working officially at the same time which will inevitably bring a question mark over the current firm indications”, the shipbroker noted.

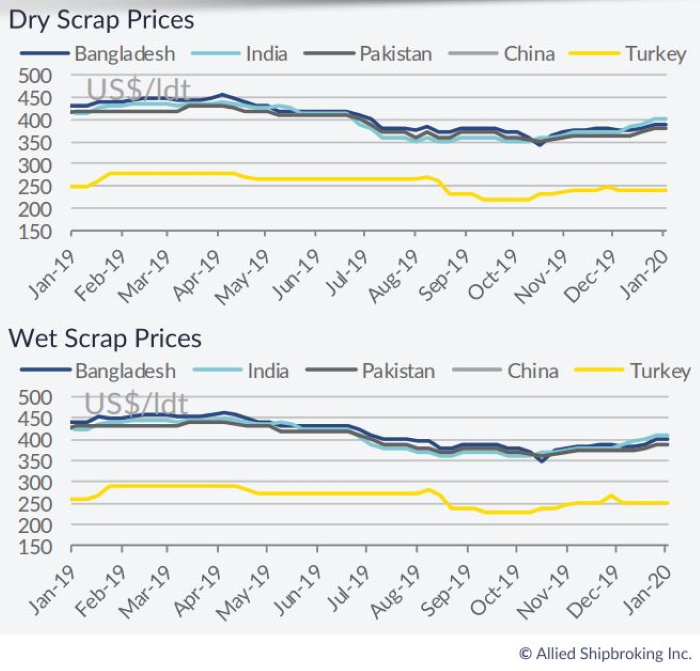

Meanwhile, in a separate note this week, Allied Shipbroking added that “Given the improved fundamentals in the ship recycling market and the slumped freight rates levels being noted, interest for scrapping has remained robust this past week with several units being sent to the breakers’ yards. India and Bangladesh are monopolizing interest as of late, with the latter struggling to keep up with the intense competition now being brought upon the market by the former. Efforts from local breakers in Bangladesh is continuing to attract new tonnage for the time being. However, with a fresh wave of units being expected to be sent to the breakers yards after the Chinese New Year, it will be interesting to see if this trend holds over the coming days. Meanwhile, India’s momentum may have slowed down last week due to a negative shift in steel prices, but this is expected to be only temporary in nature. The much healthier fundamentals in the country and the improved offered prices are expected to continue to attract a fair amount of fresh tonnage. Finally, Pakistan continues to remain in the sidelines for now and despite the increasing appetite for demolition activity noted in the rest of the industry, local breakers are still finding it difficult to keep up with the competition and attract any significant portion of the “tonnage pie” so far”, Allied concluded.

GMS, the world’s leading cash buyer of ships added that “a sudden surge of tonnage pre-Chinese New Year holidays has started to put pressure on recycling markets once again, particularly as the already limited number of Recyclers of large LDT tonnage has started to get booked up. There is a shortage of capable and performing End Buyers, especially those whose banks will sanction large Dollar value L/Cs on the heavier lightweight units (Capesize bulkers, VLOCs and VLCCs) and this seems to be (with the exception of tankers) one of the most active sectors for the recycling of older assets at present. After a stunning surge which saw prices improve by over USD 35/LDT over December and the early part of January, consecutive days of steel declines in India have started to put downward pressure on the local market. As such, it is worth issuing a cautionary note as we head into the long Lunar / Chinese New Year holidays this week that there may ensue several weeks of softer activity and dampened prices / demand as a result. If the current trends persist – with poorer freight rates (particularly on dry bulk vessels) – then the markets may well see a deluge of tonnage for recycling after the holidays and that will certainly put downward pressure on prices once again, just as some improved levels and market stability had started to be seen of late. Prices in both India and Bangladesh have surged above the USD 400/LDT mark in recent times (particularly for favored container units), but all of that could be in danger if supply starts to outstrip demand and fundamentals suffer going into February”, GMS concluded.

Source : Hellenic Shipping News