2019 Ends With Plethora of Newbuilding and S&P Deals

30.12.2019

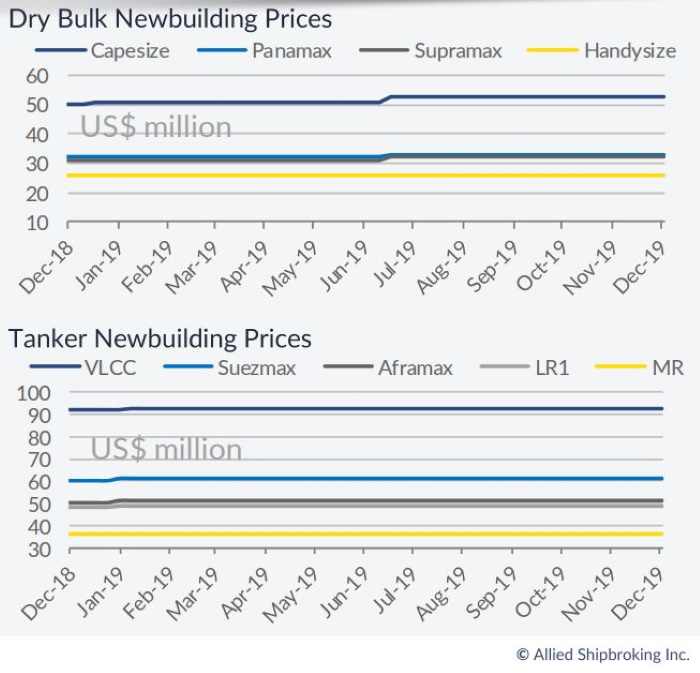

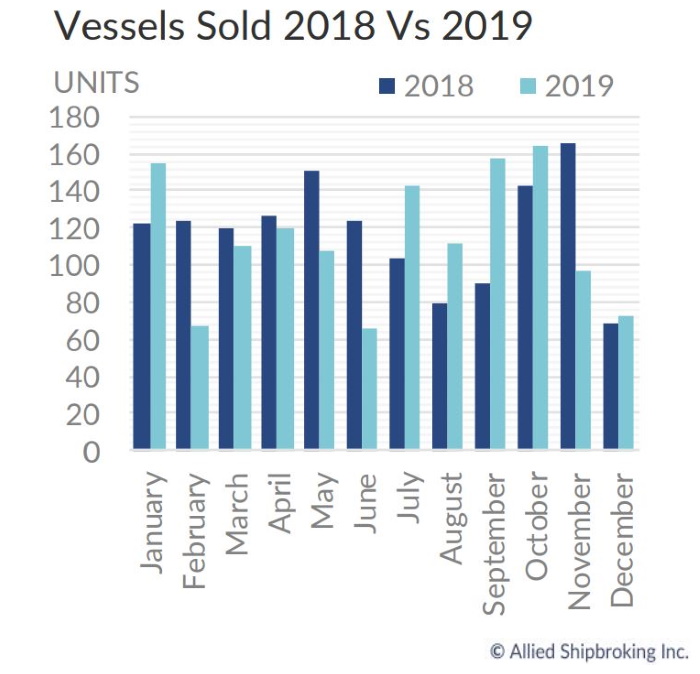

Ship owners have sought to seal a number of deals prior to the end of 2019, both in the newbuilding and the second hand markets. In its latest weekly report, shipbroker Allied Shipbroking noted that “things remained interesting for yet another week in the newbuilding market. In the dry bulk sector, we witnessed an another good rally for the Kamsarmax size segment, which saw its Orderbook boosted by 4 (optional + 4) units. This may have caught many by surprise, given the steep negative pressure that the overall dry bulk market is currently under. However, seeing the year-to-date decrease of more than 35% of the Panamax-Kamsarmax Orderbook (while the orderbook to fleet ratio still remains below the 10% mark), current trend makes more sense. With the tanker market showing a firm face (in line somehow with that of freight earnings as of late), while, at the same time, buying appetite in Gas market remaining robust, new ordering contracts will probably finish the year on a positive momentum, contradicting that way the bearish mood noted during the biggest part of the year”.

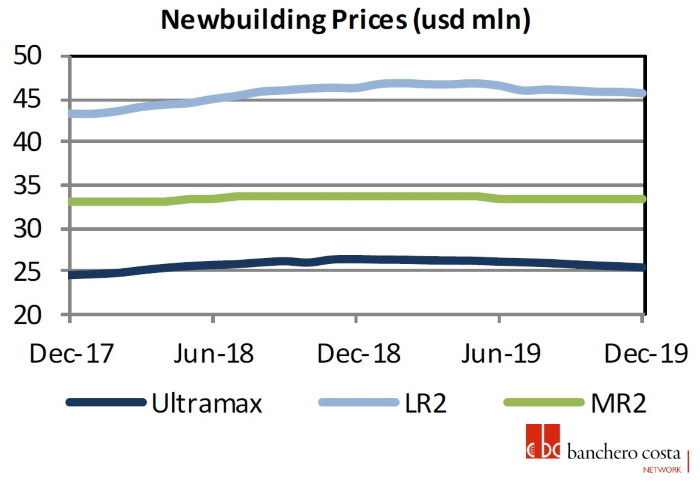

In a similar weekly note, shipbroker Banchero Costa said that “in the dry bulk market, Seacon booked 4 + 4 Kamsarmax units from Huangpu Wenchong for delivery in 2021 and 2022. Fujan Southeast received an order for 4 x 22,500 dwt Handysize to be delivered during 2021. Japanese owner Fukujin Kisen ordered 2 x Kamsarmax at NACKS with delivery early 2021. In the gas market, Avance Gas (division of Stolt –Nielsen) signed 2 x 91,000 cbm LPG carriers to be delivered in late 2021 and early 2022 at Daewoo. AET Tanker signed 3 x Suezmax shuttle tankers with Hyundai. Vessels are expected to be delivered in 2021 and 2022 when will start a long TC to Shell”.

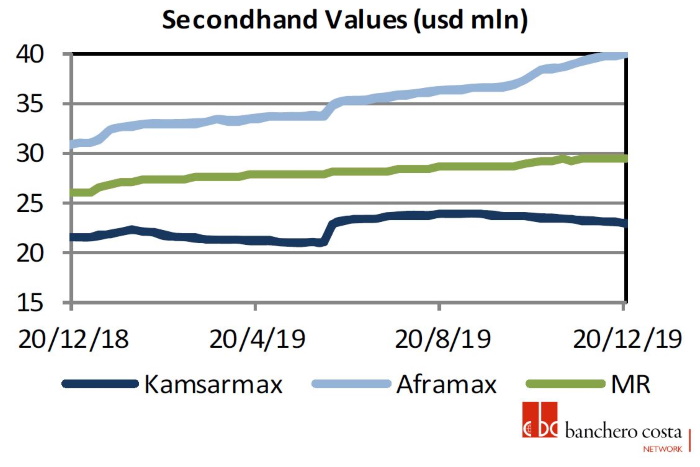

Meanwhile, in the S&P markets. Banchero Costa said that “four Capesize were sold to Chinese buyers for a reported price of $84 mln: TIGER GUANGDONG, TIGER SHANDONG, TIGER LIAONING all 180,000 dwt built 2011 Qingdao Beihai and the 2010 built sistership TIGER JIANGSU. A few interesting sales registered in the Supramax segment, a resale Ultramax HULL NR 214 about 63,700 dwt prompt delivery was sold for $28 mln to undisclosed buyers whilst a 58,000 dwt built in 2013 at NACKS, the DRACO OCEAN was reported sold for region $14,8 mln. A high standard BWTS fitted 2003 Mitsui Supramax MAROUDIO about 56,000 dwt Mitsui was sold to Indonesians for region $9 mln (with fresh SS) and a younger sistership ALAM MANIS about 56,000 dwt built 2007 was sold again to Indonesians for region $10,8 mln. The most active market for SAP is no doubt the product tanker where a few sale were reported and requirements in general are many. The Japanese controlled FREJA BALTIC about 47,500 dwt built in 2008 at Onomichi (pump room) fitted with BWTS was sold for about $16 mln to Greeks (rumored being Spring Marine) whilst the PYXIS DELTA about 47,000 dwt built in 2006 at Hyindai Mipo was sold to Indians for a price of region $13,5 mln. Another slightly older sister units LIBERTY and FIDELITY about 47,000 dwt built in 2004 at Hyundai Mipo were sold for a soft $10,75 mln which evidences the prompt due date of the SS”.

Allied also mentioned in its report that “on the dry bulk side, it was an interesting week yet again. With interest moves noted across all size segments and with no specific direction in terms of age range, it seems as though the SnP market will finish the year on at a satisfactory pace (even if there is some of feeling that asset price levels are slowly softening). With all that being said, while given the fragile state and volatile nature being seen in the market for some time now, it is hard to point to any clear direction right now. On the tankers side, it was a rather good week in terms of SnP deals being concluded. However, we witnessed some slight slowdown in activity when compared with the week prior. At this point, it seems that there is a disconnect, given the upward momentum noted in freight earnings and the level of activity being seen. Notwithstanding this, we can expect a good flow of transactions to continue through after the holiday period fades away”.

Source : Hellenic Shipping News